24/7 roadside assistance (towing and labor): This protection answers the call when you need help fast, whether it’s for a flat tire, gas or a dead battery.Classic car: Includes cars between 19-25 years old that are of greater than average value for the same make and model of that year.New car replacement: Pays for the cost of a brand new replacement car if your car is totaled or stolen.Satisfies your SR-22 requirement if you do not own a vehicle. Nonowner or nonowner SR-22: Covers you when you don’t own a car but borrow or rent one frequently.This allows web designers to easily create sites that will adapt as needed to display for the correct devices, from phones and tablets, to laptops and more. The finish was very fine (metal flake Burgundy).

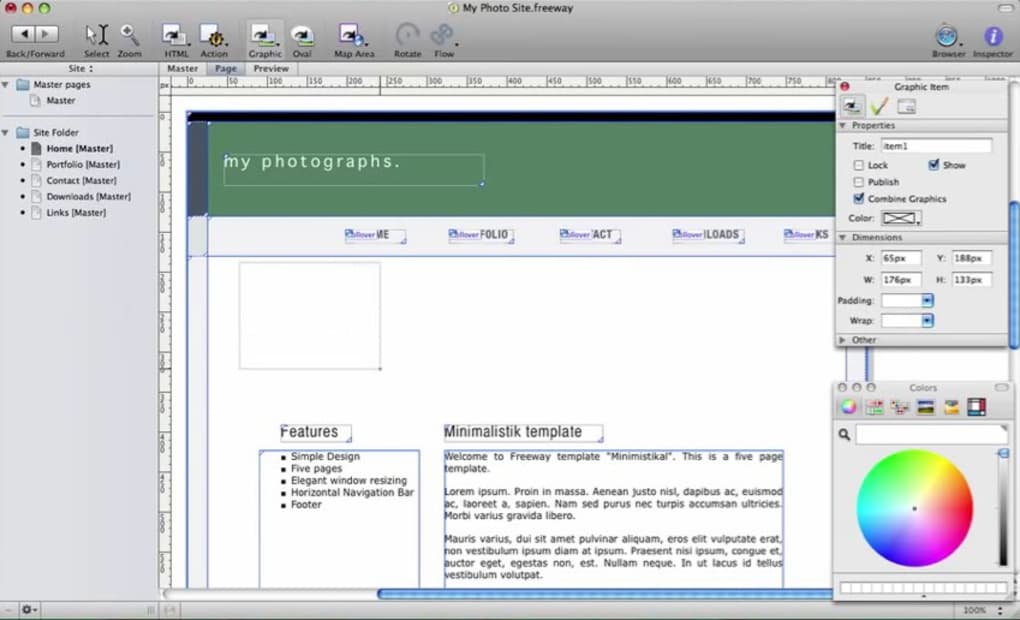

FREEWAY PRO 7 REVIEW DRIVERS

Uninsured/underinsured motorist: Covers accidents with drivers who either don’t have adequate insurance or have no insurance at all. Softpress Freeway 7 Pro now features responsive design for creating websites that automatically adapt to display for any device. Freeway Insurance is a national chain that focuses on auto insurance for drivers considered high risk,' such as those with at-fault wrecks, tickets or DUIs on their records. I picked up the Freeway and noticed how solid and tightly made it felt. SR-22: Proves you have insurance meeting your state’s minimum requirements. Rental car reimbursement: Covers rental car costs while your covered car is repaired. Covers medical expenses and possibly loss of income, essential services, survivor benefits and accidental death and funeral expenses. The Pro version’s abundant features might be worthwhile for patient users with money to burn, but I can’t recommend Express to even. No-fault: Also known as personal injury protection. Freeway Express feels like a bumpy stretch of dead-end road. Medical payments: Covers medical costs for you or anyone else involved in an accident regardless of who’s at fault. Liability: Covers property damage when you’re at fault. Gap: Pays off your loan balance if your car is totaled.

DUI: While not technically an insurance policy, it’s difficult to get insurance with a DUI on record - Freeway says it can help those with poor driving history find coverage.Comprehensive: Covers damage not related to an accident, such as fire, theft, acts of nature and more.

Collision: Covers damage to your vehicle in case of an accident regardless of who’s at fault. Depending on the provider you choose, coverage options might include: Instead, it connects you with various auto insurance companies. Freeway Insurance doesn’t directly sell coverage.

Collision: Covers damage to your vehicle in case of an accident regardless of who’s at fault. Depending on the provider you choose, coverage options might include: Instead, it connects you with various auto insurance companies. Freeway Insurance doesn’t directly sell coverage.

0 kommentar(er)

0 kommentar(er)